A Broader View

A Broader View

SUMMARY:

American Catholic families increasingly cannot afford Catholic higher education.

Private college, including room and board, cost an avg. of $1,187 per credit hour.

Great Books Program credits cost only $250 per hour for the first 48 hours of college credit;

The remaining Great Books Program college credits cost from as little as $250, depending upon the participating college selected.

The Great Books Program helps make Catholic higher education affordable.

Most Catholic parents hope to avoid sending their children to public, secular colleges with the attendant dangers to faith and morals so prevalent there. They hope to send their children to private four-year colleges for a sound, Catholic education. But that is increasingly unaffordable for families.

College tuition is typically based on a per-credit-hour basis, plus some minor fees (e.g., application fee). A credit hour is an “hour” (50 minutes) of class per week, for 14-16 weeks (a semester). The standard minimum number of hours for a bachelor’s degree in most US colleges and universities is completion of 120 hours, typically completed at the rate of 15 per semester, 30 per year for four years. Many foreign colleges and some US ones have 90 credit hour bachelor’s degrees, which typically require three years to complete. The cost-per-credit-hour therefore becomes central to calculating college tuition at most colleges, though a minority of colleges simply have a semester charge for a fixed curriculum.

College tuition is typically based on a per-credit-hour basis, plus some minor fees (e.g., application fee). A credit hour is an “hour” (50 minutes) of class per week, for 14-16 weeks (a semester). The standard minimum number of hours for a bachelor’s degree in most US colleges and universities is completion of 120 hours, typically completed at the rate of 15 per semester, 30 per year for four years. Many foreign colleges and some US ones have 90 credit hour bachelor’s degrees, which typically require three years to complete. The cost-per-credit-hour therefore becomes central to calculating college tuition at most colleges, though a minority of colleges simply have a semester charge for a fixed curriculum.

$ 142,544 – AVG. FOUR YEAR COLLEGE COSTS. 2009-2010 tuition and fee costs for private, four-year colleges increased on average 4.4% or $1,096 per year from the prior year to a whopping $26,273 per year (up 47% since 2002 when it was $18,596) or over $105,092 for four years; at the same time average college room and board costs climbed 4.2% or $377 per year to $ 9,363. That totals to an average of over $35,636 per year or $142,544 for a four-year degree (Ivy League colleges hover about $50,000 per year – $200,00 for four years

$ 1,187 PER CREDIT HOUR. Calculating the same average on a per hour basis, using the standard minimum of 120 hours for a bachelor’s degree, with room and board added in, the total cost is $1,187 per credit hour ($1,666 for the higher end colleges).

$ 250 PER CREDIT HOUR IN Great Books Program. The Great Books Program cost per credit hour is $250 for the first 48 hours ($12,000 total) of the program. The remaining hours vary from $250 (online courses) up to $600 (c. $912 including room and board, at Benedictine College).

Great Books Program BACHELOR’S DEGREES FROM $28,088. Eight bachelor’s degrees in the Great Books Program can be obtained for under $32,000.[iv] Another 31 Great Books Program bachelor’s degrees may be completed at residential colleges for a range from $28,088 (Campion Australia, including tuition, fees, room and board[v]), to $93,722 (Benedictine College, including tuition, fees, room and board) [iii] utilizing three annual 5% reenrollment discounts with the Angelicum Great Books Program), and absent any scholarships.

TEXTBOOKS REACH $1,000 PER YEAR. Add another $4,000 to tuition and fees at most colleges since the typical college student also pays another $1,000 per year on textbooks.[vi] Here are some pricey examples:

Acta Philosophorum The First Journal of Philosophy: $1,450

Encyclopedia of International Media and Communications: $1,215

Management Science An Anthology: $850

History of Early Film: $740

Biostatistical Genetics and Genetic Epidemiology: $665

Companion Encyclopedia of Psychology: $600

Feminism and Politics: $600

Concepts and Design of Chemical Reactors: $593

Advanced Semiconductor and Organic Nano-Techniques: $570

Ethics in Business and Economics: $550

Great Books Program BOOKS ARE UNDER $300 PER YEAR. By contrast, the Ignatius Critical Edition books used in the Great Books Program Angelicum Great Books Program cost approximately $11-13 each or roughly $300 per year. Our Great Books Study Guides are presently included in the price of the tuition. Since Ignatius does not have all of the books used in their Critical Editions yet, the current cost is under $300 per year (in fact, 80% of the four-years of readings are contained in Britannica’s Great Books of the Western World, a set which can be obtained new for $989 or used for much less).

CAN THE AVERAGE AMERICAN AFFORD PRIVATE COLLEGE ANY LONGER?

While college costs have continued to climb through the roof, average hourly earnings of Americans ($18.98 per hour) have declined in purchasing power to about ½ what they were in the 1970s, after adjusting for inflation. From January 2007 to 2009, 5.1 million jobs were lost; 13.7 million people were out of work and 32.2 million people were on welfare (food stamps). Many retirement plans are all but worthless. $9.7 trillion was spent on bank bailouts for a very few of the largest banks. An astonishing number of homes – 19 million – stand vacant. U.S. debt is approximately $12.3 trillion + $6.3 trillion Fannie Mae/Freddie Mac debt assumed by the US government = $ 18.6 trillion dollars. This vast sum does not include the federal government’s un-funded contingent liabilities such as Social Security/Medicare/Medicaid estimated at $107 trillion. State and local governments owe another $2.4 trillion. All of this will, of course, have to be paid on the backs of the already overburdened US taxpayer. The American middle class is now an endangered species.

While college costs have continued to climb through the roof, average hourly earnings of Americans ($18.98 per hour) have declined in purchasing power to about ½ what they were in the 1970s, after adjusting for inflation. From January 2007 to 2009, 5.1 million jobs were lost; 13.7 million people were out of work and 32.2 million people were on welfare (food stamps). Many retirement plans are all but worthless. $9.7 trillion was spent on bank bailouts for a very few of the largest banks. An astonishing number of homes – 19 million – stand vacant. U.S. debt is approximately $12.3 trillion + $6.3 trillion Fannie Mae/Freddie Mac debt assumed by the US government = $ 18.6 trillion dollars. This vast sum does not include the federal government’s un-funded contingent liabilities such as Social Security/Medicare/Medicaid estimated at $107 trillion. State and local governments owe another $2.4 trillion. All of this will, of course, have to be paid on the backs of the already overburdened US taxpayer. The American middle class is now an endangered species.

During the 1970s it was possible for American college students to pay their own tuition by working part time, without student loans or any help from their parents. Besides paying their own tuition, many students in the 1970s could also afford their own car and apartment. Today, college students have to get deeply into debt and have their parents help pay their tuition; students can barely afford to pay for food on their own.

One result is that parents and students increasing hope for scholarships, grants and especially student loans to make that more affordable. Beside these being uncertain and hence difficult to use in planning, there is a serious downside to student loans – sometimes crushing debt.

Consumer debt in the US stands at nearly $2.5 trillion dollars – and based on the latest Census statistics, that works out to be nearly $8,100 in debt for every man, woman and child that lives here in the US. We’re talking about consumer credit – which does not include debt secured by real estate. 36% is credit card debt (credit card delinquencies were at the third highest level on record);[vii] 64% is derived from loans that are not revolving in nature. This type of debt would include car loans and student loans. So if you’re thinking that number has mortgage debt in it, it doesn’t. The typical homeowner spends around 17% of their disposable income just to own their homes and cars. Renters outpace homeowners by over 8% and spend nearly 25% of their income on these same types of debts. Nearly one in every 35 households in the United States filed for bankruptcy in 2007 alone.

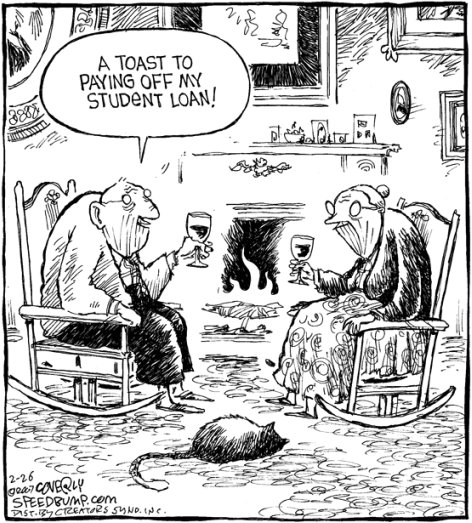

The Project on Student Debt, a research and advocacy organization in Oakland, Calif., used federal data to estimate that 206,000 people graduated from college with more than $40,000 in student loan debt – that’s a ninefold increase over the number of people in 1996, using 2008 dollars. Furthermore, on top of student loans most students have credit card debt they amassed from paying living expenses – $3,200 on average.

One survey of college graduates revealed an overwhelming number of respondents that were sidetracked from graduate or post-graduate study due primarily to existing student loan debt.[viii] Does this mean that if we were not faced with the mountain of student loan bills that we would be a more well-educated society? Of course, with many more well-educated Catholics.

The university and college tuition loan-finance system can now fairly be described as a continuous debt-generating apparatus. Students enter into college or university under the premise that once they receive their degree they will find high-paying jobs, enabling them not only to pay back their tuition debt along with other fees but be able, at the same time, to live a comfortable existence. Most recent graduates will tell you that nothing could be further from the truth.

Many entry-level wages for formerly “high-paying,” post-graduate positions were slashed – if those jobs did not disappear altogether. After their graduation, and with the onset of severe recession, more and more students have found themselves having to accept low-paying jobs in places like coffee shops or the retail industry just to cover their daily expenses.

For example, Cortney Munna, a 26-year-old graduate of New York University, has nearly $100,000 in student loan debt from her four years in college. Like many middle-class families, Cortney and her mother began the college selection process with a grim determination. They would do whatever they could to get Cortney into the best possible college, and they maintained a blind faith that the investment would be worth it.

Today, however, Ms. Munna, a 26-year-old graduate of New York University has nearly $100,000 in student loan debt from her four years in college, and affording the full monthly payments would be a struggle. Universities like N.Y.U. enrolled students without asking many questions about whether they could afford a $50,000 annual tuition bill. Then the colleges introduced the students to lenders who underwrote big loans without any idea of what the students might earn someday — just like the mortgage lenders who didn’t ask borrowers to verify their incomes.

Meanwhile Ms. Munna does not want to walk away from her loans in the same way many mortgage holders are. It would be difficult in any event because federal bankruptcy law makes it nearly impossible to discharge student loan debt. It is utterly depressing that there are so many people like her facing decades of payments, limited capacity to buy a home and a debt burden that can repel potential spouses.

Meanwhile Ms. Munna does not want to walk away from her loans in the same way many mortgage holders are. It would be difficult in any event because federal bankruptcy law makes it nearly impossible to discharge student loan debt. It is utterly depressing that there are so many people like her facing decades of payments, limited capacity to buy a home and a debt burden that can repel potential spouses.

How could her mother have let her run up that debt? “All I could see was college, and a good college and how proud I was of her,” her mother said. “All we needed to do was get this education and get the good job. This is the thing that eats away at me, the naïveté on my part.”

Cortney recently received a raise and now makes $22 an hour working for a photographer. It’s the highest salary she’s earned since graduating with an interdisciplinary degree in religious and women’s studies. After taxes, she takes home about $2,300 a month. Rent runs $750, and the full monthly payments on her student loans would be about $700.

She may finally be earning enough to barely scrape by while still making the payments for the first time since she graduated, at least until interest rates rise and the payments on her loans with variable rates spiral up. “I don’t want to spend the rest of my life slaving away to pay for an education I got for four years and would happily give it back,” she said. “It feels wrong to me.” [ix]

WILL THE OBAMA STUDENT LOAN REFORMS MAKE A DIFFERENCE?

In July, 2010 the US Government will take over a majority of issued student loans stemming from private banks and corporate-loan companies. Newly signed loans will have a capped 3.4 percent interest rate. The loans that already exist will not be affected by this cap, which means millions of students will still have to pay back their current loans with interest rates that can easily reach 10 percent or more. New repayment terms will come into existence for loans signed only after 2014. The current repayment cap of 15 percent of disposable income will be lowered to 10 percent. Furthermore, the government can forgive some borrowers’ debts after 20 years whereas now lenders can forgive student-loan debt only after 25 years. Public servants, i.e., nurses, soldiers, and teachers, could see more relief. Their debt can be forgiven after only 10 years, and they can get assistance of up to $4,000 for tuition. In addition, a portion of their loans can be forgiven if they make less than $65,000 per annum.

In July, 2010 the US Government will take over a majority of issued student loans stemming from private banks and corporate-loan companies. Newly signed loans will have a capped 3.4 percent interest rate. The loans that already exist will not be affected by this cap, which means millions of students will still have to pay back their current loans with interest rates that can easily reach 10 percent or more. New repayment terms will come into existence for loans signed only after 2014. The current repayment cap of 15 percent of disposable income will be lowered to 10 percent. Furthermore, the government can forgive some borrowers’ debts after 20 years whereas now lenders can forgive student-loan debt only after 25 years. Public servants, i.e., nurses, soldiers, and teachers, could see more relief. Their debt can be forgiven after only 10 years, and they can get assistance of up to $4,000 for tuition. In addition, a portion of their loans can be forgiven if they make less than $65,000 per annum.

Another aspect of the student-loan reform is the increasing of Pell Grants for lower-income students. As part of last year’s stimulus package, they were raised, but they would be lowered again once the stimulus money ran out. The amount of Pell Grants is slated to increase approximately $400 to $5,975 by 2017, correlated to fluctuations in the indices of consumer prices.

These changes are very vague and do not really address the central problems most students find themselves in. The estimation of the Consumer Price Index in 2017, for example, is an example of one of the vague features of the bill. Moreover, millions of students remain saddled with incredible amounts of debt. Most of the measures contained in the bill do not consider general inflation, and none of them considers tuition inflation.

All across the country colleges and universities are raising tuition and other fees – year on year. The minuscule increases in the issue of Pell Grants during this time, for example, will be outpaced, unable to keep pace with the massive increases in tuition. Moreover, with the availability of subsidized loans issuing directly from the government, students could potentially end up paying more for tuition, as many universities and colleges would not or could not allow such an opportunity to pass them by of raising tuition.

Students therefore, even after the implementation of Obama’s student-loan “reform” program – have the potential of amassing massive amounts of debt; and this debt gets harder and harder to pay back with the disappearance of high-paying jobs along with jobs in general. Students could realistically end up paying undergraduate and or post-graduate debt decades after achieving a degree. If a student does not have a job or have one that barely allows one to pay rent, food and gas, he or she can find it next to impossible to pay back any loans – no matter the repayment terms. This cannot go on. The system of trading debt-bondage for an education needs serious reform. The government is not the answer.

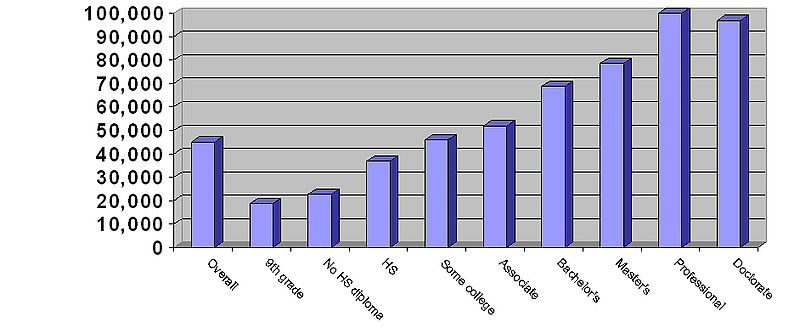

THOUGH INCREASINGLY UNAFFORDABLE, COLLEGE EDUCATION REMAINS VALUABLE

The above graph shows the median household income in accordance with the householder’s educational attainment – the correlation is very high and significant.

Apart from the critical i mportance of liberal education as a good in itself, we are left with the apparent dilemma that while a good college education results in dramatically increased income, it is often not worth the level of student loan debt students must incur to obtain it.

mportance of liberal education as a good in itself, we are left with the apparent dilemma that while a good college education results in dramatically increased income, it is often not worth the level of student loan debt students must incur to obtain it.

This explains one of the principal goals and benefits of the Good Books Program – to reduce the cost of Catholic higher education thereby making it available to more Catholic families and students, and to others, who either cannot afford it or who wish to avoid the crushing debt that increasingly accompanies it.

[i] Top 10 US News & World Report, Aug 2009 [ii] http://colleges.usnews.rankingsandreviews.com/college/liberal-arts-search [iii] 2009-10 College Prices (College Board) [iv] The 2009-10 academic year figures were slightly lower. Due to price increases at some participating colleges the figure is now slightly higher. However, taking advantage of tuition discounts can still keep the cost below $29,000, or even less for families. Prices subject to exchange rates fluctuations and other changes without notice. [v] Room and board costs at Campion College Australia range from $100 AUD to $325 AUD per week for 17 weeks. In US$ that comes to $84-$273 per week at current rates, or $ 1,428-$4,641 per semester. The figure above uses the lower sum. [vi]12 Most Expensive College Textbooks in America, By Lynn O’Shaughnessy , May 10, 2010 [vii] Consumer Debt Statistics by Erin Peterson, Bankrate.com [viii] Project on Student Debt, a research and advocacy organization in Oakland, California Your Money, by Ron Lieber who writes the Your Money column, which appears in The NY Times on Saturdays.